New: customize order line and export documents for outside EU

In the past few days, a lot of changes have happened on the platform for international shipments outside the EU.

Since this year, carriers have been requiring all data to be submitted digitally when creating the shipping label.

An invoice on paper is no longer sufficient.

In order to transfer this information online, it is necessary to complete some data in the platform.

Most recent update: May 17

What has changed in the platform?

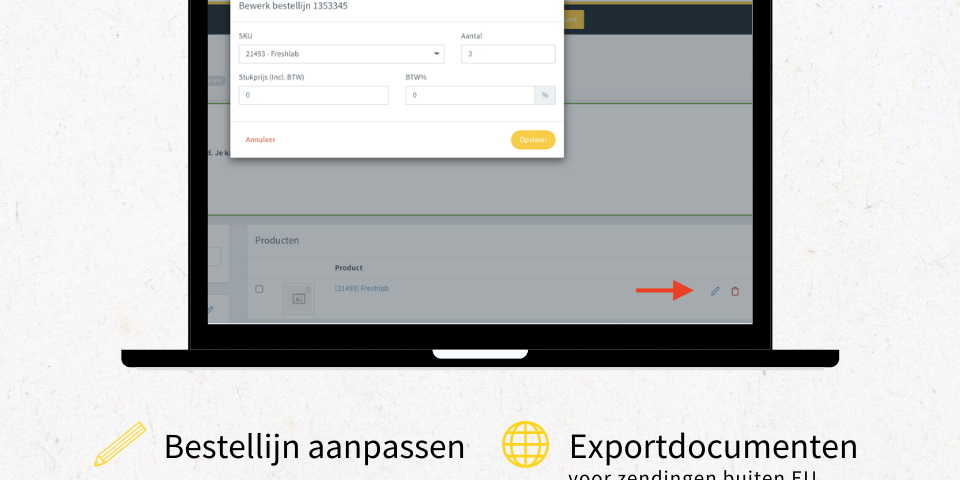

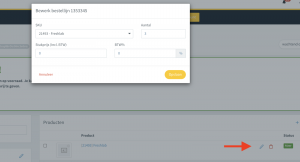

1. Customize order line

There is a new feature at orders.

Per orderlijn kan je nu een pennetje aanklikken.

Hiermee kan je de bestellijn aanpassen wanneer de bestelling in status “wachtend op vrijgave” staat.

Je zal er 3 dingen kunnen wijzigen:

- Price and VAT: You can adjust the value (price including VAT) and VAT percentage.

This becomes necessary for orders with a destination outside the EU. - SKU: You can change the SKU of an order line without having to delete and re-add the order line.

This is useful if, for example, you would like to send a different lot or an alternative product. - Number: You can change the number of items ordered from an order line without deleting the order line and adding it again.

This is useful when, for example, a customer ordered 3 items, but only 2 are in stock.

Recently there is also

Recently there is also

automatic stock on order lines possible:

The order line is automatically adjusted to still ship the order.

Orders that we cannot resolve this way are automatically placed in Q& A.

When new stock is delivered, all you have to do is release the Q&A.

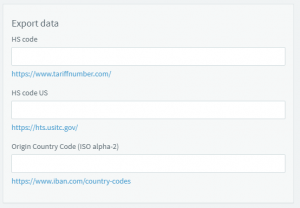

2. HS code and country of origin

Next, it is necessary to per SKU (1) the HS code and (2) indicate country of origin (iso-code 2).

You will find a link where the abbreviations are listed by country.

For the US, there is a separate HS code.

If for all SKUs the same, this can be forwarded to us by email and we will load this info in 1x.

- HS code: https://www.tariffnumber.com/

- HS code US: https://hts.usitc.gov/

- Origin Country Code: https://www.iban.com/country-codes

For example: BE for Belgium and NL for the Netherlands.

Completing the data is important.

With these modifications, we can generate an automatic commercial or pro forma invoice ourselves.

This will be done automatically so you don’t have to load this into the system yourself.

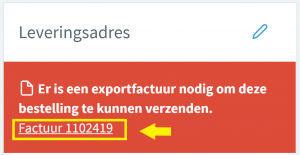

You can view the sample invoice by clicking on the link in the red notification for a shipment outside the EU (above the shipping address).

As of today, the integration has been activated for all shipping companies.

Verzend je naar UK via DPD dan moet je een HMRC nummer instellen.

Dit doe je via instellingen > account > HMRC nummer.

Je HMRC nummer kan je registreren via https://www.gov.uk/log-in-register-hmrc-online-services.

Q&A

The export orders will remain in Q&A for now so you will receive a notification that an export invoice is due.

You can then check the export invoice yourself and make adjustments.

That way you can be sure that everything is in order.