BREXIT update

On Dec. 24, 2020, an agreement was reached between the United Kingdom and the European Union regarding the Brexit.

Since January 1, 2021, there has been a provisional arrangement in force to enable trade between the EU and the UK.

Below we inform you about the conditions you need to meet, depending on the carrier you work with.

The information below was communicated by the carriers.

For that reason, this page with Brexit information will be kept up-to-date so you will always find the most recent information here.

* last update: 14/1/21 *

As of 1/1/2021 customs declarations required for all shipments between the UK and the EU.

Even though the trade agreement resulted in “zero tariffs” (zero customs duties), it is still mandatory to generate a customs declaration and therefore a commercial or pro forma invoice.

In most cases, no customs duties will be granted to goods that meet all the “rules of origin. VAT will be levied.

Net daarom zijn douaneaangiften vereist om goederen de grens te laten oversteken.

Landenspecifieke beperkingen blijven van toepassing en ook eventuele bijhorende licenties zijn vereist.

How do you take advantage of the “zero tariff” on customs duties?

To benefit from this, it is necessary to show the country of origin on the commercial or pro forma invoice of a shipment to both B2C (private) and B2B (business) recipients.

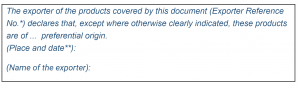

How to prove country of origin?

You do this using the statement below. Important! These documents must be provided before the goods are presented for customs clearance.

Without this statement, DHL cannot claim the customs duty exemption.

* For all shipments from UK to EU: Exporter Reference No. = GB EORI number * For shipments from the EU to the UK: , Exporter Reference No. = REX number (Required only when the value of the shipment exceeds €6,000 / £5,700 ** May be omitted if the information is on the document itself

VAT changes in the UK

This change is separate from the UK-EU trade agreement and applies to shipments from any country (including EU countries) imported into the UK.

- Most shipments valued over £135, will be subject to VAT on import.

- For B2C shipments worth £0-£135, VAT will be collected at the point of sale, and is the responsibility of the seller.

E-commerce

Does your webshop sell to customers in the United Kingdom?

Then your shipments are subject to customs duty.

Even when customers decide to return their purchases.

DHL Express with its ‘easy returns service’ makes it possible to re-import returned goods into the EU without paying customs duties.

When you use the billing service ‘Duties Taxes Paid’(DTP), you as the sender pay the VAT and import duties (if applicable).

Be transparent to your customers and list an all-in price on your webshop to avoid surprises.

Northern Ireland

For shipments to this area, everything remains unchanged.

In fact, there are no formalities with customs papers for trade with the EU.

Learn more about DHL: https://www.dhl.com/be-en/home/about-us/brexit.html

Most recently:

DPD is temporarily suspending orders between the UK and the EU, but packages are still being sent to the UK from Belgium.

This is a temporary measure and on Wednesday, Jan. 13, DPD hopes to resume services to the European Union.

More information can be read in DPD UK’s announcement: https://www.dpd.co.uk/email/dpd-pausing-eu-services-07012020.html

DPD still allows shipping packages to the United Kingdom.

Some services that will not currently be available:

– Collection Request – Direct Pickup parcelshop delivery – Parcelshop returns – MPS (multi parcel shipments) – DPD Guarantee – DDP in case of single parcels – Shipping to Channel Islands (Guernsey, Jersey) – Shipping of dangerous goods / goods subject to sanitary controls – Shipping of excise goods (tobacco, beverages containing alcohol, etc.) – –

DPD’s Brexit checklist

1. EORI number

- A Economic Operators Registration and Identification (EORI) number is needed before you trade outside the EU Customs Union.

- The number is needed because it ensures a standardized exchange of data in customs procedures.

- In a customs transaction, both parties must have an EORI number

- More information about EORI?

See FPS Finance

2. HS code classification

- Customs uses a European HS (Harmonized system) code to classify products

- The code consists of at least 8 digits: use this code with the data you send to DPD, so DPD can provide the correct customs declaration

- With this code, Customs knows (1) which products you declare (2) how much import duties and other taxes must be paid on these products

- Important: If the code entered is incorrect, you may pay a different price and risk a fine

- HS codes can be found on the website of the FPS Finance find

3. Always provide all necessary information

- If any data is missing, customs cannot approve the package and it will be returned (surcharge of 5 euro per package)

- Sender: name, address, zip code/city, country, phone number, e-mail address

- shipment: number of packages (=1), weight, type

- package: description, quantity, unit value, INCOterm, HS code, country of origin

- recipient: name, address, zip code/city, country, cell phone number, e-mail address and EORI (if business recipient)

- For B2B shipments: VAT number of the recipient and EORI number

Creation of shipping labels for customs

- DPD Shipper: this tool ensures you meet Brexit requirements

- Web service & plugins: DPD Shipper web service or a necessary update for the plugins can be found here.

4. Documents

- The basis for the customs declaration is always the commercial invoice

- Customs must be able to find all necessary information on the invoice.

For this, DPD UK will print a ‘regenerated’ invoice based on the available data - In some cases, you may be asked for the original copy of the invoice.

You will receive this request through customer service and you must Within 24 hr available via e-mail forwarding.

5. INCO terms + billing terms.

- This determines who bears responsibility in the transaction

- By default, this is with DPD: DAP (Delivered at Place). Here the seller is responsible for the export and the receiver/buyer is responsible for the import.

- Which party pays the VAT and import duties?

2 possibilities at DAP- NP – Duties & Taxes NOT PAID: The seller pays the transportation cost and export handling.

The recipient/buyer pays customs duties and VAT.

→ add this information to the shipping costs on your website so the customer is informed - DP – Duties & Taxes PAID (on demand): The seller pays transportation costs as well as import duties and VAT. Only possible after approval of contact person at DPD.

- NP – Duties & Taxes NOT PAID: The seller pays the transportation cost and export handling.

6. Registration with UK customs (HMRC).

- VAT must always be paid by the sender for packages ≤ £135.

For this reason, you must register with HMRC: Register for VAT – GOV.UK (www.gov.uk)

7. Power of Attorney (POA) document.

- In order to ship to the UK after the Brexit, you must provide the POA document to DPD.

This is a written power of attorney that DPD Nederland B.V. can do customs clearance of your packages, under your name. - Also remember to attach to the POA an extract from the Crossroads Bank for Enterprises (CBE).

- The POA for Belgium, can be downloaded here: https://www.dpd.com/be/nl/support/internationaal/brexit/brexit-document/

- Then send the signed version of the POA to brexit@dpd.be

8. Inform your shop customers of the changes

-

- Transit times: This remains unchanged for shipments to the UK.

It is possible, however, that in the period shortly after the Brexit, delays may be possible due to customs procedures. - Customs regulations do not apply to Ireland, but delays are possible as these packages are shipped through the UK.

- The recipient in the UK has 5 calendar days time to pay import and tax surcharges.

Failure to do so in a timely manner will result in the package being returned.

- Transit times: This remains unchanged for shipments to the UK.

More info on Brexit and DPD, can be found on this page.

PostNL announces that no further delays due to Brexit measures are expected as of January 7, 2021.

The impact of the covid19 measures on customs control is decreasing due to PostNL’s ability to present all required documents.

The expected delays for shipments to the UK due to corona measures is between 4 and 7 days.

For more information, take a look at PostNL’s website.

Bpost reports that since early 2021, packages to certain foreign, non-EU destinations must include additional information.

Bpost reports that since early 2021, packages to certain foreign, non-EU destinations must include additional information.

Under the new regulations, as a sender, you are required to share some information about the shipment: Electronic Advance Data(EAD) An example of the required data:

- Postal rate paid

- Currency of paid postal rate

- Number of items

- Value of items

- Currency

- Description of items

- Net weight

- HS code

- Country of origin (Origin of Goods).

Given the new regulation, from now on it is extremely important that all requested information is attached to non-EU shipments.

On February 1, 2021, all input fields will be mandatory in the bpost tools.

By providing the correct data, customs clearance will be smoother (avoiding delays and surcharges).

More information and context on this change can be found in this presentation.